Written by: Jacob Dayan

Regardless of size, any business owner should be well-acquainted with the “big five” — the five financial statements integral to accurate performance reporting and forecasting. These are: (1) the balance sheet; (2) the income statement; (3) the cash flow statement; (4) the statement of change in equity; and (5) the statement of financial position. While each statement is essential in its own right, the balance sheet is imperative for assessing and optimizing a company’s resource utilization.

This article looks at the balance sheet from the top down before breaking down its components to help give small business owners a better understanding of how they can use this critical statement.

The balance sheet is a financial statement that balances what a company owes and what is owed during a specific period. It allows you to compare your assets alongside your liabilities and, if applicable, your shareholders’ equity. When prepared correctly, a balance sheet should be balanced, as the name implies; the total of assets should be equal to the sum of liabilities and shareholders’ equity.

As previously mentioned, the balance sheet shows how a company utilizes and finances its assets. Your small business bookkeepers and accountants must work together to ensure sure these are updated each month — especially if you are planning on taking out a loan or acquiring investors.

The balance sheet’s main components are the assets mentioned above: liabilities and shareholders’ equity. Assets include cash, property, and inventory, places in order of liquidity. Usually, the most liquid (easily converted into cash) assets are placed at the top. Liabilities include business taxes, loans, payroll, accounts payable — any financial debt or obligation with which your business has to contend.

If your small business has shareholders, you will list shareholders’ equity alongside liabilities. To calculate Shareholders’ equity, take the amount of money initially invested into the company plus retained earnings and subtract any shareholders’ distributions.

But wait — that’s not all. Assets and liabilities can be broken down further into current assets, non-current assets, current liabilities, and non-current liabilities.

Current assets are assets that the company expects to be consumed or liquidated (converted into cash) sometime within the next 12 months. Typically, this includes assets such as loans taken and inventory. Non-current assets are assets that are not expected to be consumed or liquidated within the next 12 months. Equipment, vehicles, and buildings are all usually considered non-current assets.

Current and non-current liabilities work the same way. Liabilities expected to be paid within the next 12 months, such as credit card debts, taxes owed, and short-term loans, are considered current. Liabilities that are not expected to be settled within the next 12 months, such as mortgages and long-term loans, are considered non-current.

For a statement with such importance, the balance sheet formula is quite simple. It can be written as:

The rationale behind this is quite simple: a company must pay for its assets by either taking out a loan (a liability), using money from an investor (issuing shareholders’ equity) or utilizing retained earnings.

An example where this formula is applied is as follows: A bakery owner decides to go to the bank and take out a 5-year, $8,000 loan for his business. Once the loan is successfully taken out, it will be reflected on both sides of the balance sheet since the loan will increase both assets and liabilities by $8,000.

Because this bakery owner runs a very small business, he has no investors. Shareholders’ equity remains $0.

Assets (+$8,000) = Liabilities (-$8,000) + Equity ($0)

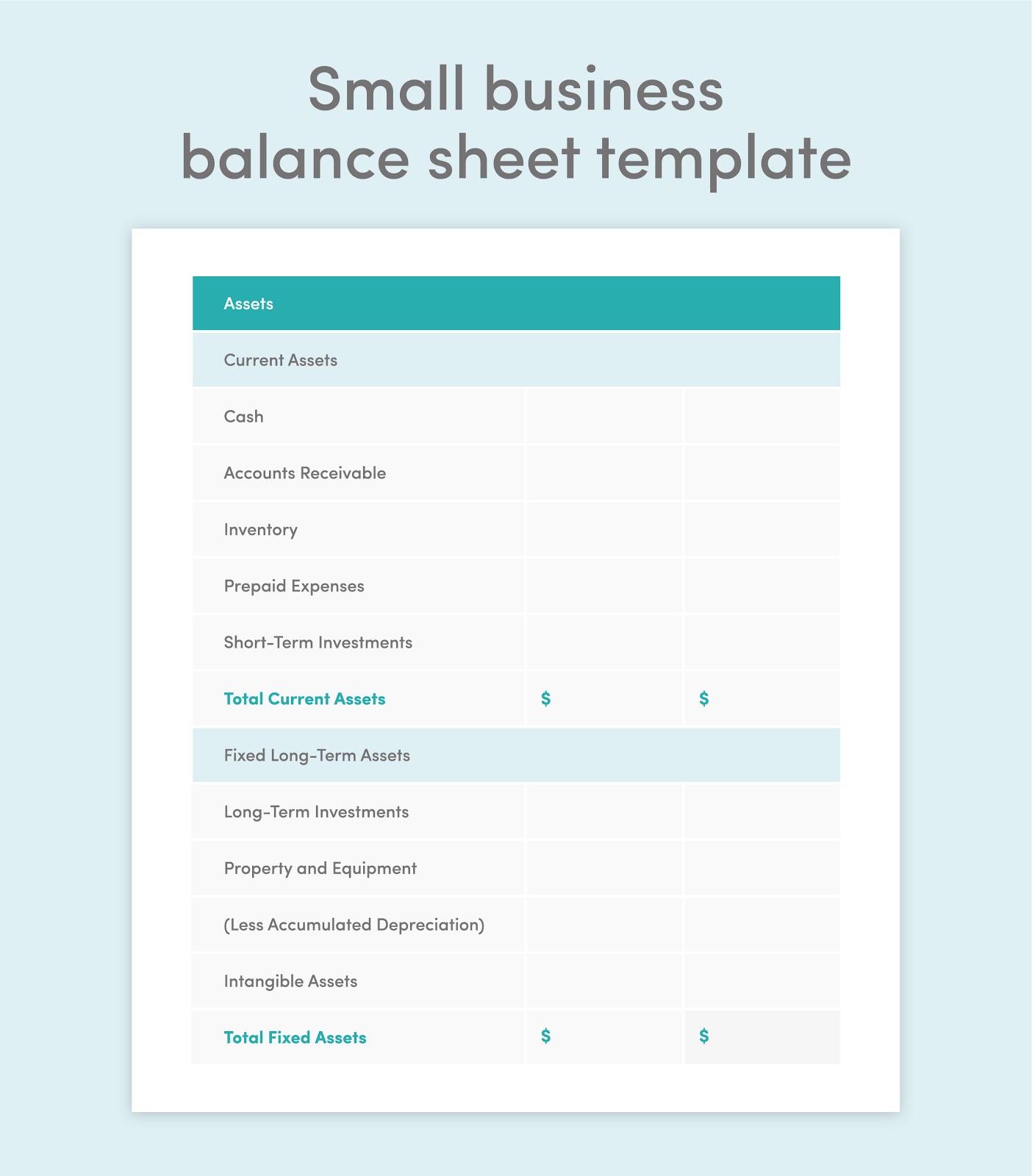

To help visualize how a small business would use a balance sheet, we have included this template:

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.