Written by: Jacob Dayan

Sometimes referred to as the “big five,” the balance sheet, the income statement, the cash flow statement, the statement of change in equity, and the statement of financial position are must-know financial statements for business owners. Regardless of entity or industry, these documents are crucial to the accounting process for any business; each has its purpose and role in assessing a business’s financial well-being.

This article examines the cash flow statement—and, specifically, the minutiae of direct vs. indirect cash flow.

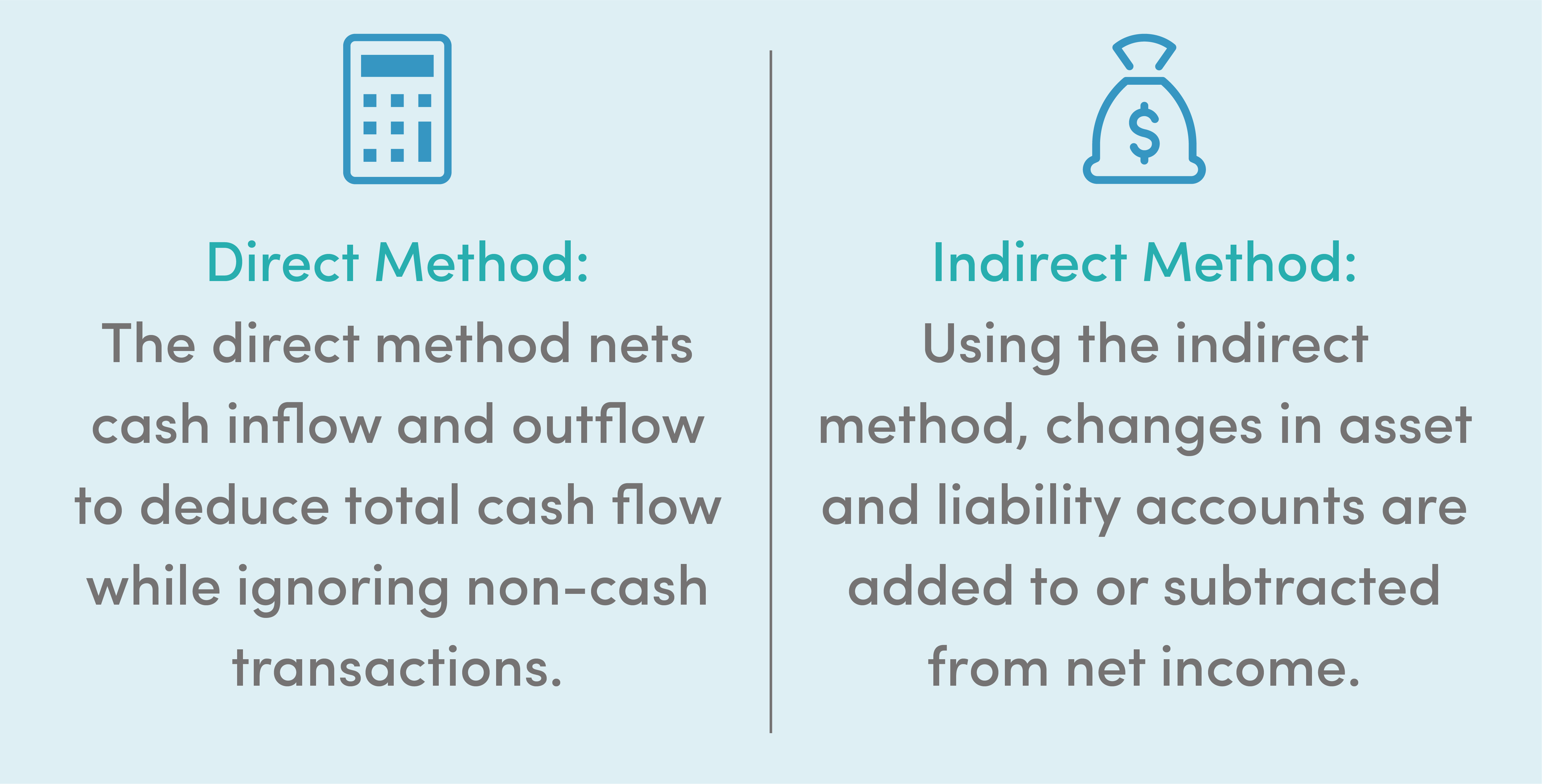

The direct method, also known as the income statement method, is one of two methods utilized while crafting the cash flow statement—the other method being the indirect method, which we will examine later. The direct method is an accounting treatment that nets cash inflow and outflow to deduce total cash flow. Notably, non-cash transactions, such as depreciation, are not accounted for using the direct method.

The direct method is often used in tandem with the cash method of accounting, where money is only accounted for when it changes hands.

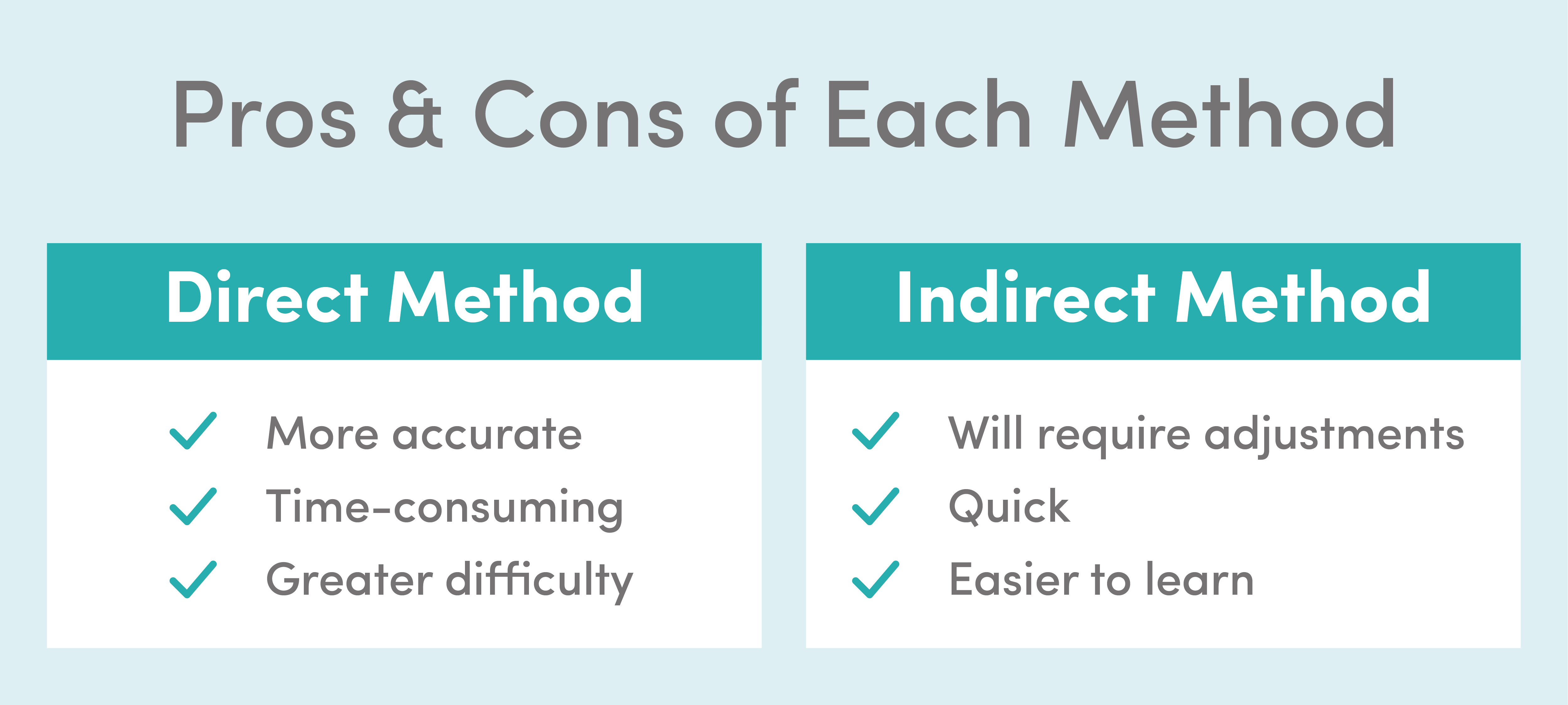

While favored by financial guides, the direct method can be difficult and time-consuming; the itemization of cash disbursements and receipts is a labor-intensive process. To add to the complexity, the Financial Accounting Standards Board (FASB) requires a report disclosing reconciliation from all businesses utilizing the direct method.

This report must plainly show the reconciliation between net income and cash flow from operating activities, listing the net income and adjusting it for non-cash transactions and balance sheet account changes. These added hoops to jump through are enough to persuade many businesses to eschew the direct method in favor of the indirect method.

Related: What is an Accounting Period?

Unlike the direct method, the indirect method uses net income as a baseline. Using the indirect method, after you ascertain your net income for a specific period, you add or subtract changes in the asset and liability accounts to calculate what is known as the implied cash flow. These changes to the asset or liability accounts present themselves as non-cash transactions such as depreciation or amortization.

Because the cash flow statement is more conducive to cash method accounting, one can think of the indirect method as a way for businesses using the accrual method to report in terms of cash on hand. As such, it requires additional preparation and adjustments after the fact. It is also not quite as precise as the direct method.

Because most businesses operate using the accrual method of accounting, the indirect method is more widely used. The indirect method is also much quicker than the direct method because it utilizes information readily available on the income statement and the balance sheet.

Here are a few other key differences between direct and indirect cash flow:

Both methods have their advantages and disadvantages. The direct method is preferred by the FASB and itemizes the direct sources of cash receipts and payments, which can be helpful to investors and creditors. However, it is time-consuming and less popular. Meanwhile, the indirect method has the edge on speed and ease of use, despite lacking accuracy.

The truth is that neither method is genuinely better than the other — it depends on which is right for your business. If you want to talk to a professional small business accountant about which method is suitable for you, schedule a consultation with FinancePal today!

Related: eCommerce Accountants

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handleRead more “Bozeman Grooming”

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.