Written by: Jacob Dayan

Entrepreneurs are no strangers to the term “burn rate” — a ubiquitous term in the startup marketplace. But what exactly is burn rate — and how can you manage it? This article examines the concept of burn rate and the various factors that contribute to it.

In simplest terms, burn rate is the rate at which a company loses — or “burns through” — its capital over the course of conducting business operations. The concept of managing your burn rate has become incredibly prevalent in today’s startup sphere as more and more new businesses take longer and longer to turn a profit.

Burn rate is chiefly used to calculate a business’s “cash runway” — the amount of time a business can operate at a loss before the coffers run dry.

The term became ingrained in the business lexicon during the rise of startup culture, where many businesses undertake multiple investment rounds before achieving profitability. In between investment rounds, burn rate becomes a crucial metric as it dictates when additional funding stages need to take place in order to avoid insolvency.

Burn rate gained some infamy as a metric due to its role in the dot-com bust; a prevailing financial theory at the time stated that a high burn rate directly correlated with the rate at which the business acquired new clients. Needless to say, this theory was dead wrong, and many startup finance experts have since changed their tune on how to handle burn rate.

Vital as it is, calculating startup burn rate is a relatively straightforward process. There are two types of burn rate: gross burn rate and net burn rate.

Gross burn rate refers to the amount of cash spent in a single month. To calculate net burn rate, you need to find your net spend by subtracting your revenue from your expenses. While gross burn rate has specific applications in accounting for startups, net burn rate is more helpful in providing a more unambiguous indication of cash runway. Unless you are an accountant, the term “burn rate” simply refers to net burn rate for all practical purposes.

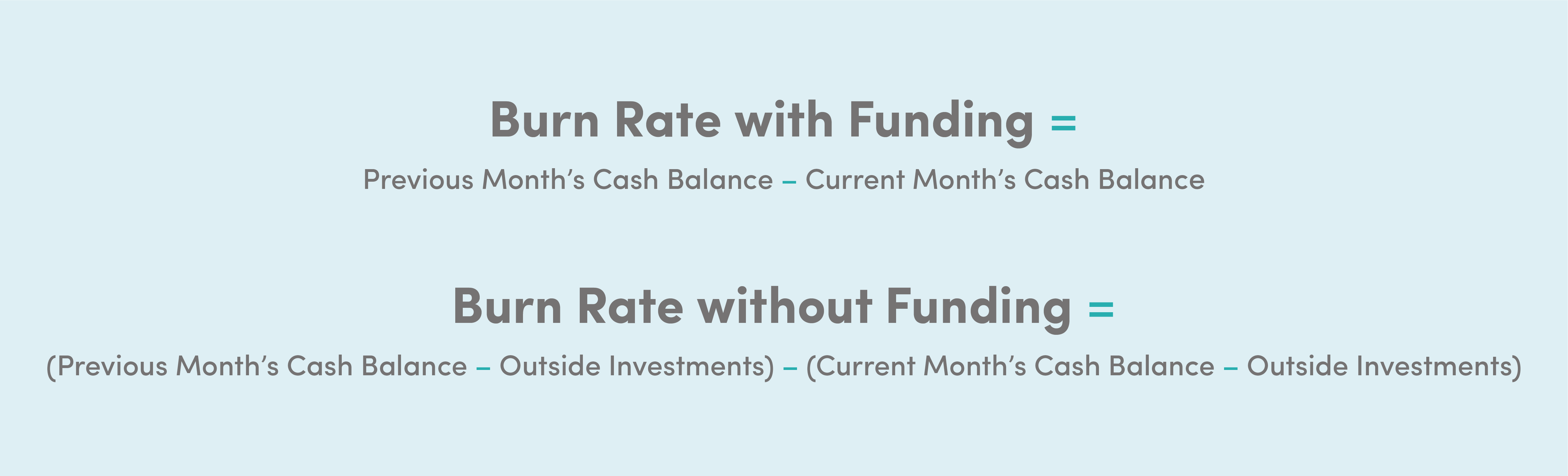

There are two primary methods to calculate your burn rate; one entails using venture capital funding or other investments, and the other does not.

Calculating your burn rate with venture capital or other investment funding is as simple as looking at the cash flow statement; it will contain all the information you need.

To calculate burn rate for a given month, subtract the cash balance for the month from the cash balance in the previous month like so:

Burn Rate = Previous Month’s Cash Balance – Current Month’s Cash Balance

Much like when including venture capital or other investment funding, you will gather direct vs. indirect cash flow information from your cash flow statement. The primary difference is that you will exclude all capital from outside investments. Your formula will look more like this:

Burn Rate = (Previous Month’s Cash Balance – Outside Investments) – (Current Month’s Cash Balance – Outside Investments)

Typically, the burn rate calculations yield a positive number. But there are a few circumstances that may result in your burn rate coming back negative. If this happens, it simply indicates that your business earned more money than it spent in the past month. If you just underwent a successful round of funding, for example, your burn rate could be negative if calculated with venture capital or investment funding.

If you specifically excluded investor funding in your calculations, it means that your business’s revenues exceeded its expenses. In the event that your burn rate is zero, it simply means that your business earns the same amount of money as it spends.

Once your startup or business earns more than it spends, burn rate is rendered meaningless as a metric; it is only used for companies that are not yet profitable.

Burn rate isn’t restricted to a monthly basis. In fact, it is easy to calculate your average burn rate over any specific period. To do so, execute a simple mean function: repeat the process above for as many months as desired. Add the monthly burn rates together and divide the sum by the number of months included. For example, you would add six consecutive monthly burn rates together before dividing by six to get your six-month average burn rate.

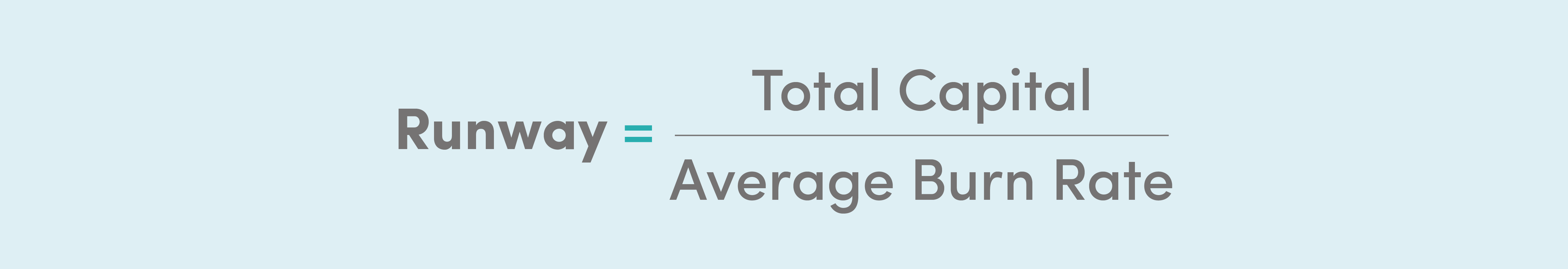

One of the primary uses of burn rate is to calculate runway — the amount of time a business can operate at a loss before you run out of cash. Because burn rate reflects the monthly rate which your business burns through capital, you extrapolate burn trends to figure how many months you have before you “burn” through your cash.

To calculate cash runway, divide the amount of money you have now by your average burn rate, like so:

Runway = Total Capital ⁄ Average Burn Rate

The resulting figure is how many months you have left before your coffers run dry — assuming constant expenses and revenue and no additional outside investment, of course.

For the sake of example, let’s say your current cash holdings total $250,000. Last month’s cash holdings totaled $300,000. To calculate your burn rate for the most recent month, subtract 250,000 from 300,000.

Burn Rate = $300,000 – $250,000 = $50,000

Then, to calculate your cash runway, divide your current cash holdings ($250,000) by your monthly burn rate ($50,000).

$250,000 / $50,000 = 5 months

In this example, your business can only operate for five more months before running out of cash. That gives you five months to secure additional investment or mitigate your current burn rate if you need more time.

If your burn rate turns out higher than expected or otherwise makes you feel uneasy, it may be worthwhile to employ one of the following strategies to help lower your burn rate. This can be accomplished either by lowering expenses, increasing revenue, or securing additional investments.

A minimum viable product is a sort of early access release — a prototype made available to select customers before the final product is ready for the marketplace. This allows you to obtain initial feedback that will enable you to cut costs on product features that your customers may not want.

Every startup owner dreams of rapid scaling. However, truth be told, premature scaling has killed many otherwise promising startups. Instead of spending your dwindling capital on additional workforce or office space, try pledging it towards return-bearing spend only, such as supplemental raw materials for increased manufacturing output.

Sometimes you have to lose before you can win. If absolutely necessary, consider downsizing your workforce or scaling down production if the lower overhead means you can survive until your next investment round.

Burn rate is a crucial metric that every startup needs to track diligently. Not only does it forebode the potential lifespan of your business, but a favorable burn rate can attract additional investors; cash consumption signals investors whether the company has the potential to be self-sustaining or if it will perpetually need additional financing.

It is easy to think of accounting and bookkeeping as necessary evils to keep the IRS off your back. But a highly competent financial team can provide essential business insights, find crucial tax savings, and allow business owners to spend less time stressing the financials and more time serving customers. Sign up to get a custom quote today for FinancePal’s professional financial services.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Diferencias entre la contabilidad y el manejo de libros contables

Contabilidad y manejo de libros contables para empresas nuevas (startups)

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.