Written by: Jacob Dayan

Simply put, an invoice is a document that itemizes and records a transaction between a buyer and seller. When running a small business, an invoice is typically sent to a client after you have delivered the product or rendered the service but before payment has occurred.

When invoicing another business, the invoiced amount gets entered into their accounts payable. This means the money is coming out of their pocket. On your end, it gets entered into your accounts receivable — and into your pocket.

When it comes to accounting for small business owners, one of the most important aspects of invoices is that they provide concrete documentation of transactions. This can standardize payment information for your accountants and help defend you against IRS audits.

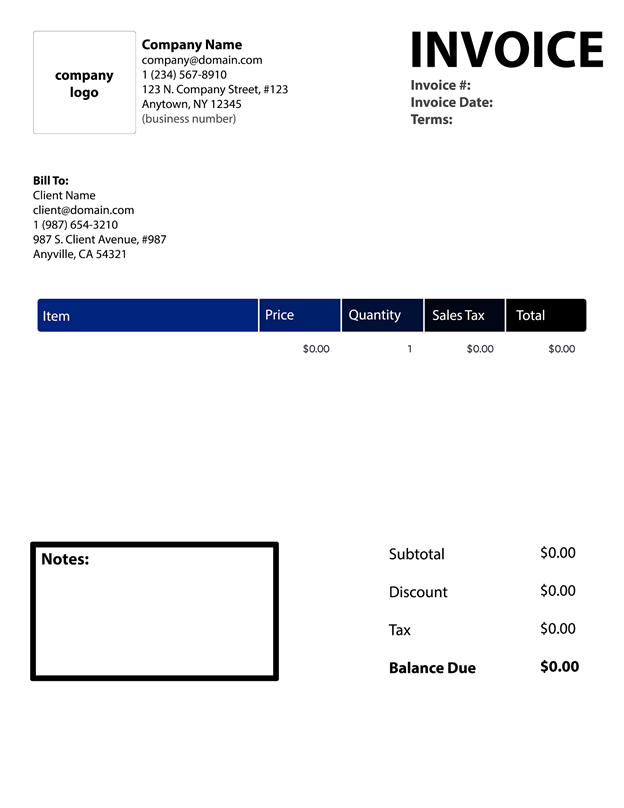

A professional invoice consists of several key components:

– Contact information (name, email, phone number, address, and business number of your business)

– Bill To section (the name, email, phone number, and address of your client)

– Itemized product or service details

The invoice number is a unique identification number that can be useful for internal and external tracking and reference.

The invoice date provides a timestamp for when the transaction has been officially recorded. The invoice date dictates both the credit duration (if applicable) and the due date of the bill, which typically falls 30 days after the invoice date. The invoice date can also be used by your client a timestamped proof of purchase in case they need to return items or have a payment refunded.

These outline how quickly payment is to be expected. For small businesses and freelancers, Net 30 is the most common invoice payment term. Net 30 means that the payment is due 30 days from the invoice date.

This section of the invoice contains a table where you can itemize and describe each product or service rendered. This is useful for consolidating multiple transactions into one invoice, if necessary. This section includes items, price per item, quantity, sales tax, and total price.

Here, you can put any notes you have regarding the transaction, be it a thank you note to your client or further relevant information.

Just because a document contains all the previous sections doesn’t make it an effective invoice. A good invoice document presents information in a clear, understandable manner, with clear demarcations for each type of information. Here is a good example of an invoice; you can download a pdf here.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handleRead more “Bozeman Grooming”

Discussed options for my business with Brian and he was very helpful in suggesting how best to handleRead more “Bozeman Grooming”

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.