Written by: Jacob Dayan

As a small business owner, you are tasked with quickly establishing a working knowledge of virtually all aspects of running a business, including financial management. However, if you own an insurance company, you are faced with an exceptionally difficult challenge due to the risks and financial requirements associated with running this type of business.

Proper financial management and reporting are important because you are responsible for ensuring that you can pay out policyholders at virtually any point in time. To avoid the common missteps of insurance accounting, start by reading this guide, and if you decide you need assistance with accounting and managing the financial aspects of your insurance business, FinancePal is here to help.

If you have little to no understanding of statutory accounting principles or the basics of insurance accounting, we recommend reading this post from start to finish. However, if you have a specific question you want answered, use these links to navigate through the post:

For any industry, there are going to be nuances that require you to make some adjustments to your accounting processes. When it comes to insurance accounting, there are several special considerations that make insurance accounting principles unique:

If you need an introduction to general accounting for a better understanding of basic concepts, start with our accounting tips for small businesses and learn the difference between bookkeeping and accounting.

Let’s dive into some of the fundamental factors of insurance accounting that make it unique from other industries. With a better understanding of these industry-specific attributes, you can implement proper insurance accounting practices for your business.

The first thing to note is that the insurance industry is generally divided into two overarching specialties:

Whichever distinction your insurance business falls under will impact certain aspects of your accounting practices. A few of the important differences are:

The accounting method you use for your insurance company will determine when you track expenses and income. There are two general accounting methods:

When considering cash vs. accrual accounting, it can be tempting to lean toward cash-basis accounting because of its simplicity. However, accrual-basis accounting will give you a better long-term view of your business’s financial health and allows you to account for insurance policies when they are sold—on the basis that you have the reasonable expectation that the policyholder will pay their premium—instead of when the premium is paid.

Due to the nature of the insurance industry, there are certain unique transactions that need to be accounted for, such as:

Due to the unique financial relationships that insurance companies have with policyholders, there are a separate set of accounting principles that apply to insurance accounting, known as the Statutory Accounting Principles (SAP). The SAP revolves around three core values that are designed to protect policyholders:

All insurance companies are required to use statutory accounting when preparing their financial statements because of the risky nature of the industry. This risk is due to the fact that insurance companies are wagering that only a small number of policyholders are going to need to collect on their coverage amounts and that their revenue from policy sales will cover these payouts. However, if the payouts exceed the amount of liquid assets the company has, it may have to file bankruptcy and potentially even be dissolved completely.

So, in order to protect the financial well-being of your company and uphold your responsibility to policyholders, it is essential that you follow statutory accounting principles.

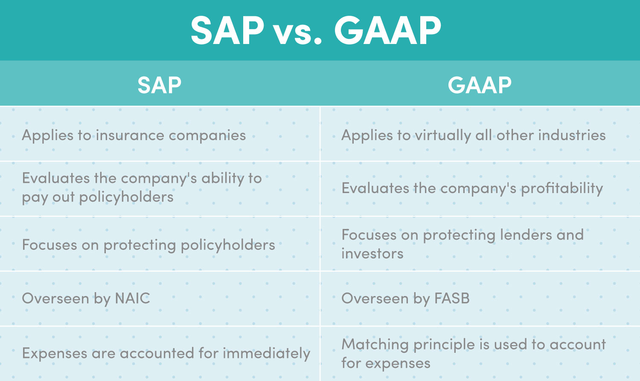

The General Accepted Accounting Principles (GAAP) are the accounting procedures followed by the majority of industries, whereas SAP are the accounting procedures used by insurance companies. While SAP falls under the GAAP, there are certain aspects that make this set of procedures different:

Understanding these principles is important for correctly implementing statutory accounting at your business.

When it comes to insurance accounting, there’s a lot of financial uncertainty involved. These tips will help you run your business smoothly and protect the longevity of your agency:

When it comes to implementing insurance accounting practices that will help you understand your business’s financial health, there are some useful reminders you should keep in mind:

Upholding these best practices on top of running your own insurance agency might seem impossible—after all, there are only so many hours in a day. Fortunately, it is not up to you to do everything on your own. Instead of putting your insurance business’s livelihood at risk due to incorrect accounting, allow FinancePal to be your resource for all things insurance accounting.

FinancePal is a comprehensive financial management solution for small businesses, including insurance agencies. Over the last few years, we have helped thousands of small businesses like yours implement the best accounting practices based on their needs and industry. FinancePal can help you get your insurance company’s finances on track by providing:

We can also help you navigate the other financial challenges that come with running your own business like payroll setup and filing your small business taxes.

Accounting also plays an important role in preparing your taxes. Carefully tracking your expenses can be especially useful in helping you reduce your tax bill. This is because there are certain deductions that may apply to your insurance business. While deductions can save you money, it’s important to have accurate financial records that you can refer back to when tax season comes to make sure you’re correctly claiming relevant expenses.

Some of the most common deductions that insurance companies can take advantage of include:

In addition to knowing which deductions apply to you, you should also be aware of the deadlines for filing and making payments on your business income.

If you find the thought of preparing your business’s taxes on your own overwhelming, consider working with a professional tax preparer to ensure everything goes smoothly. At FinancePal, we have tax experts on staff who can help with your small business tax preparation and ensure that your insurance agency’s income taxes are filed on time and paid correctly.

Having correct insurance accounting principles in place is the first step to a more stable financial future. With these insurance accounting basics in your pocket, you’re better prepared to take on the financial responsibilities of running your insurance agency and upholding your duty to your policyholders. And if you find yourself in doubt, the team at FinancePal is here to help.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handleRead more “Bozeman Grooming”

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.