Written by: Jacob Dayan

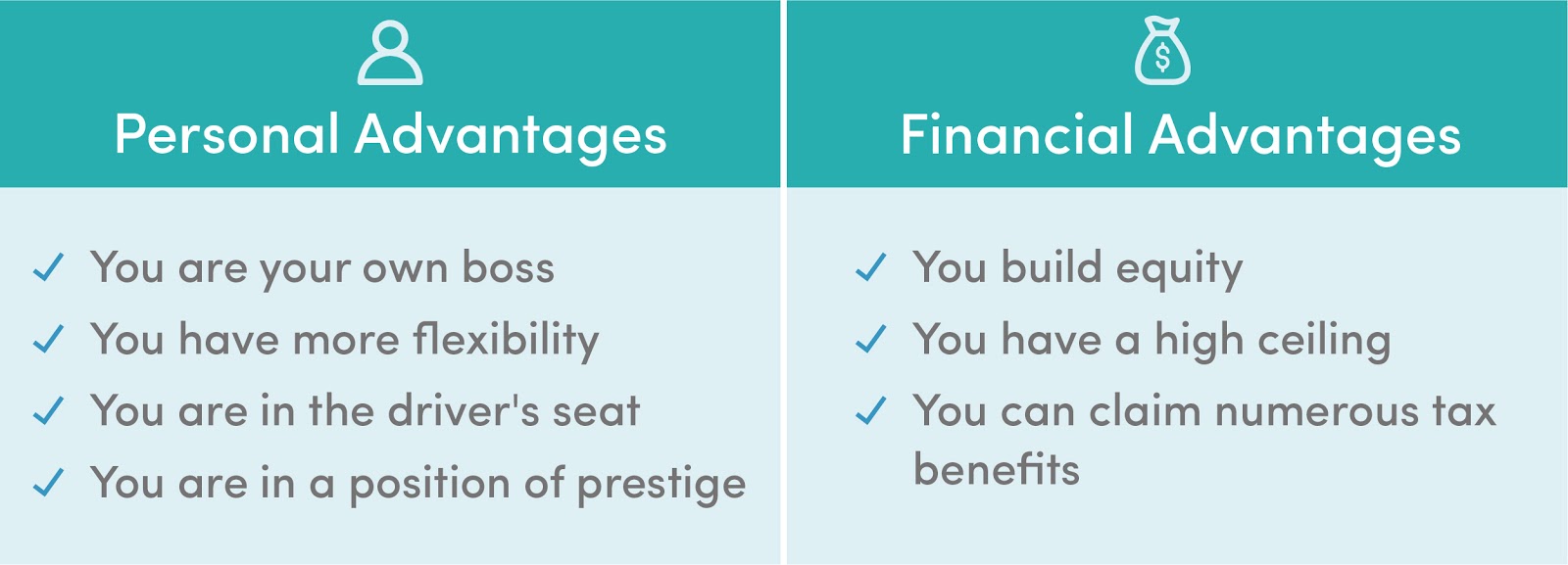

Many Americans are drawn to the entrepreneurial lifestyle, and this isn’t without reason. Running your own business comes with personal freedom, a strong sense of purpose, and not least of all, a plethora of business tax benefits at your disposal. However, as any entrepreneur will tell you, there is no opportunity without risk; small business owners have to face unique challenges while getting their companies off the ground and in the black.

This article weighs the unique advantages and challenges that small business owners face. If you are an entrepreneur considering starting your own business or expanding your current one, apply these advantages and challenges to your current situation to help inform your path moving forward.

One of the most exciting aspects of running your own business is the prospect of not having to answer to anybody but yourself. Many startups and small businesses were founded by former employees looking to break free from the corporate ladder. Your hours may be long, but you make them. The responsibility falls on your shoulders, but you can handle it your way. For many, the liberation and shouldering of personal responsibility inherent in running a small business is part of the allure.

With more autonomy comes greater flexibility. Business decisions are yours to make; will you carve out and conquer a market niche? Or will you expand to cover a wide variety of goods and services? Small business ownership flexibility allows you to adapt to volatile market conditions to help maintain profitability and pounce on the endless opportunity.

Many employees become frustrated with the lack of control they gave over their company’s future. And the bigger and more involved corporate offices become, the less control the average employee has. Owning and running a small business puts destiny in your hands, giving you control that many employees can only dream about.

It’s no secret — running a small business is a prestigious position to be in. Your customers look up to you as a valuable service provider. If you have employees on your payroll, they look up to you as a boss. And whether you run a partnership, sole proprietorship, LLC, or corporation, you quickly become a community fixture as your brand becomes ingrained in the area you are based in; small businesses are the lifeblood of American communities, after all. On top of community brand recognition, running a small business will give you influence; local government officials often take input from their small business owners when deciding future policy.

The previous section was dedicated to the “intangibles” — the oft-cited, feel-good benefits of running a small business. On top of these, there are several financial incentives to owning a business.

As your business grows, so does your equity. You can build up a hefty amount of equity over a lifetime that you can pass on to the next generation if you choose, setting up your family for financial security for years to come. You can also use equity to fund other business ventures.

When it comes to entrepreneurship, the sky really is the limit. If you specialize in an easily scalable niche such as personal training or digital goods, you can grow as opportunity allows. And if you use past equity to fund future endeavors, you can build quite the impressive portfolio.

Because small businesses are widely recognized as the backbone of American communities, there are numerous tax benefits to help small business owners maintain profitability. For instance, partnerships, LLCs, and sole proprietorships don’t have to file federal business taxes and can deduct qualifying business spending on their Forms 1040 or 1040-SR. Additionally, in times of crisis such as the recent COVID-19 pandemic, Congress typically prioritizes small businesses when designing aid packages.

Related Reading: Accounting for Startups

While the upshot to running a small business is enormous, it is not necessarily easy. Successful entrepreneurs need to possess a tenacious drive and business sense to maintain substantial growth. Here are some challenges unique to running a business:

While overnight success stories accrue widespread coverage, many entrepreneurs recognize that these are not typical results for business owners. Carving out a niche and becoming a community fixture can take years of steady growth. In entrepreneurship, patience and perseverance are virtues of the highest order.

Because business owners shoulder the responsibility, they also burden the risk. Poor business decisions can wreck a businessman’s carefully-built equity. And if your business can’t pay its liabilities, insolvency is imminent.

Many business owners started their business because they were experts in providing a good or service, not balancing a book. However, being on top of your financials is part and parcel of running a business. Proper small business accounting and bookkeeping don’t just help maintain legal compliance — it can help find opportunities for additional profit within the crevices of the tax code.

More and more business owners see the benefit of outsourcing their financials to small business bookkeeping and accounting professionals. The long hours business owners used to waste poring over seemingly arcane financial documents and crafting statements are better spent on actually running the business. The rise of outsourced small business financial services has shifted that burden away from business owners, allowing them to devote more time to building their businesses.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.