Written by: Nick Charveron Nick

When it comes to your small business, there are a lot of different professional services you might look into to help you with the many tasks at hand. One of those professionals should be a bookkeeper. But what does a bookkeeper do exactly?

A bookkeeper is a key player in any business’s financial well-being. Bookkeepers are responsible for keeping track of and recording all of the transactions that impact your business. Sounds pretty handy, right?

They are. And, they’ll become more important to your business as it grows. While you might be able to handle minimal incoming and outgoing transactions during the start-up phase, it will become increasingly complex and time-consuming—making a bookkeeper essential.

Read our complete guide to get the answer to “what do bookkeepers do”, or if you have specific questions, you can jump through the article with these links:

What is the Difference Between a Bookkeeper and Accountant?

Does your Business Need a Bookkeeper?

According to the Bureau of Labor Statistics, bookkeepers are responsible for keeping track of accounts and recording all of a business’ transactions. Bookkeepers have been around for thousands of years and have become increasingly important as business operations, and the related transactions, have become more complex.

Today, bookkeepers often work off-site or as freelancers which can benefit your business when it comes to cost. If you think about it, it’s usually much more expensive to hire an individual employee to have on-site. And, with bookkeeping, in particular, it usually isn’t necessary.

Interested in more bookkeeping facts? Keep reading to learn more about what bookkeepers do and how they can help you make your business better.

The duties and job functions of a bookkeeper include:

On a day-to-day basis, your bookkeeper will typically be responsible for recording the financial transactions of your business. When doing so, it’s important that they use double-entry bookkeeping, the recommended method of bookkeeping practices. This will help ensure that your financial records are as accurate as possible.

When trying to answer “what does a bookkeeper do”, you should know that not every bookkeeping service is exactly the same. Some providers will offer more services than others. Bookkeepers are also sometimes responsible for certain aspects of inventory, payroll, and taxes, which we’ll dive into further in the following sections

Since bookkeepers keep track of sales and cost of goods sold, they are uniquely aware of certain aspects of your business’ inventory. As such, some bookkeepers offer inventory management as part of their services. In these cases, they can help you determine how much inventory is on hand, how much inventory is being sold, and whether there are any discrepancies. They can also make ordering recommendations.

While payroll is usually overseen by the human resources role, sometimes bookkeepers will handle payroll. In general, it depends on your bookkeeper. In some cases, they can help with everything from payroll-related forms and payments to processing payroll.

While a bookkeeper does not necessarily do your business tax returns for you, they can be instrumental in the process. Your bookkeeper or accountant will work with your tax preparer to ensure that all the information about your business’ finances is accurate. When it comes to filing your small business taxes, accurate reporting is essential to remain in compliance with the IRS and avoid hefty fines that can be harmful to your business’ financial stability.

Since they’re particularly familiar with your books, they’ll also be able to help you take advantage of any and all deductions you might qualify for, including:

It’s important to keep in mind that the IRS has strict requirements for writing off certain business expenses as well as reporting sales and use taxes. Fortunately, your tax preparer and bookkeeper or accountant should be aware of these. What’s better is that their assistance can also often save you money on small business tax preparation.

Instead of putting trust in an individual bookkeeper or hiring a costly large firm, your small business can take advantage of the broad spectrum of services offered by FinancePal. In addition to bookkeeping, FinancePal provides small business payroll and tax services that are tailored to your needs and easily accessible online. We’ve worked with businesses large and small to streamline their bookkeeping and help them thrive.

To perform their unique job duties, bookkeepers must have the following skillset:

If you’re thinking about hiring a bookkeeper for your business, you should consider these qualities when evaluating prospective providers. With FinancePal’s bookkeeping services, you’ll have top financial experts equipped with leading technology handling your books.

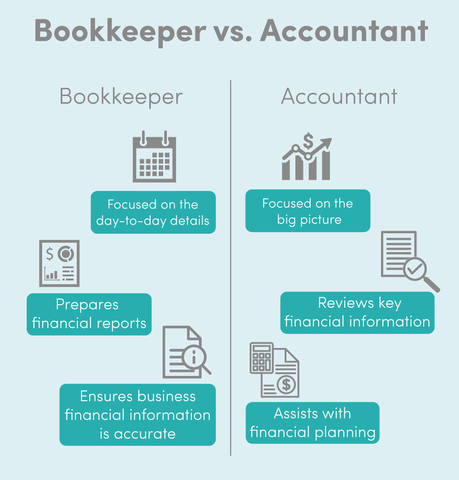

When you search for “what do bookkeepers do”, you’ve likely come across many articles that mention both bookkeepers and accountants—that can get kind of confusing. While the two are related because they both play an important part in the accounting cycle and your business’ overall financial well-being, these two positions have very different functions. Let’s break down the key differences between what a bookkeeper does and what an accountant does.

As you can see, accounting and bookkeeping are different, so these terms shouldn’t be used interchangeably. However, these two roles are intertwined and typically work together to keep your business’ finances in order.

When it comes down to it, you might be on the fence as to whether your business really needs its own bookkeeper. However, there are several key benefits to having one, including:

While it might seem like an extra expense you can’t really afford, hiring a bookkeeper doesn’t have to strain your budget. In fact, it can save you a lot in costly errors, the time you could be performing other pressing tasks, and headaches. As the owner of your business, your time is invaluable.

Think about it, learning how to record financial transactions, balance your books, and generate financial documents is a lot of work. Especially if you don’t have a financial background. On top of that, you’ll also be burning through your already limited time if you have to go back and correct a bunch of errors because you were less experienced when you started doing your own books.

So, instead of trying to figure out, “how does bookkeeping work”, you can hire a bookkeeper to handle the entire process. Doing so can make it easier to focus on the aspects of your business better-suited to your skillset, and in the end, significantly reduce your stress. Because let’s be honest, no matter how much help you have, being a small business owner is a demanding gig.

In addition to hiring a bookkeeper, it’s recommended that you also hire an accountant to ensure that your finances are handled correctly. Or, you can find a provider that offers comprehensive financial services for small businesses, like FinancePal.

Now that we’ve answered your primary questions, “what does a bookkeeper do” and “does your business need a bookkeeper”, let’s discuss how to find a good bookkeeper that you can rely on.

Besides simply reviewing their LinkedIn or website, you could also find out more about how they operate their bookkeeping services during the interview process.

Whether you’re holding formal interviews, or simply speaking with prospective providers over the phone to clarify a few points about their services, there are certain questions that can help you get the information you need to make a sound decision. Consider asking them the following:

Keep your business’ unique needs in mind when looking for a bookkeeper to find the right fit.

But first, there are few factors you should consider when selecting a bookkeeper:

At the end of the day, you should also consider whether the consultant or team is easy to collaborate with. Since you’ll need to communicate with them on a fairly regular basis, you don’t want it to be a strained relationship. Additionally, it’s important that you feel that you can trust them with your business’ sensitive financial information.

If you’re looking for a bookkeeper, don’t settle for subpar services, it could end up hurting your business. Instead, try FinancePal’s small business bookkeeping services. With us, you’ll enjoy the peace of mind that your books are balanced, your financial reporting is accurate, and you’re provided with the utmost transparency—you’ll always have real-time access to your financial information online.

Typically, there are several factors that will determine how much bookkeeping services will cost, including:

As such, the cost of bookkeeping services can vary widely. For instance, bookkeeping rates are about $20 an hour in the U.S. If you require accounting services as well, you could be looking at rates of $150 per hour or more. That can add up if you require a lot of help. Remember that while you don’t want to allocate an unnecessary portion of your budget to hiring a bookkeeper, you should be willing to pay for quality because your finances are so important to your business.

FinancePal offers flexible plans starting at $99 per month, that are designed to fit the needs of small businesses and are easily scalable as you grow. We can also create a fully customized plan that is tailored to your preferences. Plus, we offer a free one-month free trial of our services, so there’s virtually no risk!

There are endless options for hiring bookkeepers, but you won’t get the same value that you would with our services. Even our most basic plan includes:

While our Basic Plan is perfect for start-ups, our more comprehensive plans are well suited for businesses that are expanding. When you upgrade to our Plus or Custom Plan, you also get access to payroll processing, tax return filing, and audit defense—all at a reasonable cost that can actually save your business time and money.

So, what are you waiting for? Now that you have the answer to “what does a bookkeeper do”, “how much do bookkeepers cost”, and “why are bookkeepers important to your business”, you’re ready to make an educated decision about your finances. Empower your small business with the best bookkeeping services so you can focus on your success. Find out more about our services by speaking with one of our experts today!

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.