Written by: Jacob Dayan

For small and medium-sized businesses, the humble line-item budget has become an accounting staple. This budgeting format has proven invaluable for organizing proposed expenses in an intuitive and easily-digestible way, conducive to guiding spend over the coming fiscal year.

This article breaks down everything you need to know about the line-item budget — what it is, how businesses use it, the pros and cons — alongside an applied example and a template.

A line-item budget is a format for clearly presenting budgetary information for a specific period. On a line-item budget, proposed expenses are grouped into cost centers or expense categories. These cost centers are displayed in close proximity; this gives the reader a great understanding of how much money is budgeted for each cost center.

Typically, a line-item budget will juxtapose each cost center’s projected spend with its respective actual spend from the previous period. This shows the reader which cost centers will receive more or less funding than before.

The following are the critical components of a typical line-item budget:

This includes the projected expenses for the year, broken down by cost center. These expenses may consist of employee compensation, marketing, professional development, office supplies, and more.

This includes the actual amount spent on the aforementioned expenses. Comparing this to the projected costs show spending growth or shrinkage per cost center.

This includes the actual amount spent per cost center for the current year to date. Comparing this to the projected expenses shows how likely you are to hit budgetary targets.

Line-item budgets are extremely digestible and intuitive; people lacking any business experience can usually understand them and their implications. They are also conducive accurately to measuring spend growth or shrinkage compared to previous budgets.

They are not only simple to read — creating a line-item budget is a fairly straightforward process. In a corporation or medium-sized business, upper management will work with the financial department to organize projected spend into a line-item budget. For smaller companies or sole proprietorships, the business owner will craft the budget themself or outsource to their dedicated small business accountant.

There are also several areas where the line-item budget falls short. For example, the budget amounts are fixed at the beginning of the year. If the budget requires adjustment as the year goes on, it can be a large undertaking; upper management and the financial department will have to work expeditiously together to complete the updated budget as soon as possible.

Another shortfall is the lack of context; sure, you may be spending more on office supplies this year, but why? Perhaps the actual reason is that the business grew over the last year and added another department, which requires unique supplies. But because the line-item budget focuses on expenses, this is not portrayed in the data.

In larger companies with several departments, line-item budgeting can lead to departments gaming the system. While this is more of a problem with budgeting as a whole as opposed to line-item budgeting specifically, the inflexibility of yearly fun allocation can lead to departments misusing surplus funds to avoid budget cuts in the following year. For example, if a department is $3,000 under budget at the end of the year, they may spend the excess money on a new copier — even if the current one runs perfectly well — so that the $3,000 surplus isn’t cut next year.

To better visualize the creation of a line-item budget, let’s imagine a small publishing business going through the process. The dedicated accountant has broken up the budget into seven cost centers:

Let’s say this publisher has five employees: an owner/managing director, a senior editor, two editors, and an administrative assistant. The salaries cost center can be broken down like this:

1. Salaries

The benefits, taxes, and allowances cost center would be broken down this way:

2. Benefits, Taxes, and Allowances.

Typically, space and utilities will be divided by utility type, such as:

3. Space and Utilities

A typical publishing company could have a supplies and equipment department that looks something like this:

4. Supplies and Equipment

Today, many businesses will break down communications spend similarly.

5. Communications

As previously mentioned, this publisher contracts out accounting, bookkeeping, and marketing. They use the same service for accounting and bookkeeping, so it is presented as a single item.

6. Contractor and Consultant Services

And here is how they break down other direct costs:

7. Other Direct Costs

From here, the accountant will work with the managing director to increase, decrease, or maintain the amount allocated to each cost center based on last year’s performance.

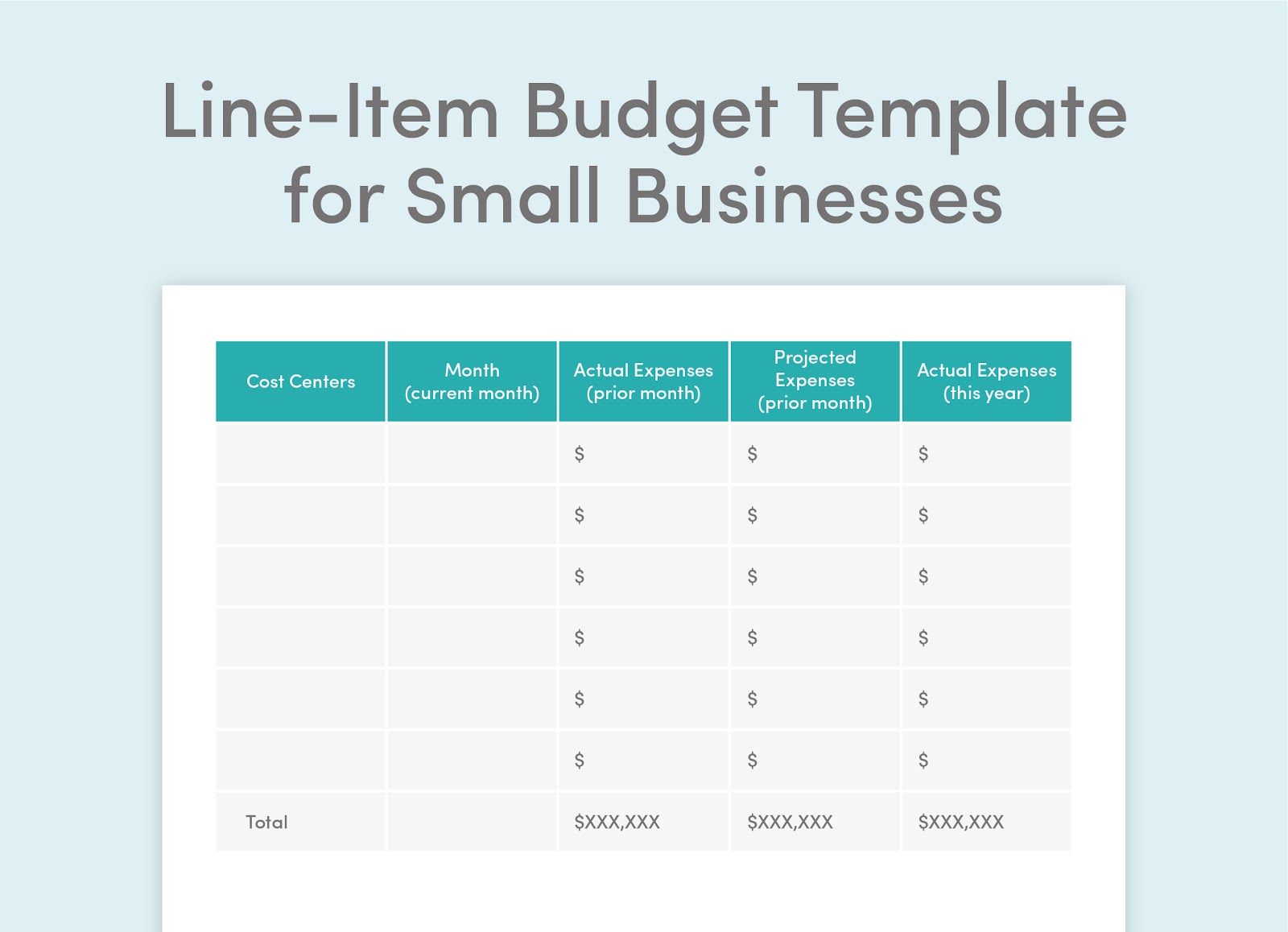

To help you better visualize how a small business can use a line-item budget, we have provided you with this free line-item budget template provided by FinancePal:

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.