Written by: Jacob Dayan

The accounting period is one of the golden rules of accounting that all accountants must follow. This article goes over what it is, the different types of accounting periods, and just why it is so important.

An accounting period is a span of time during the fiscal or calendar year in which accountants perform functions such as gathering and aggregating data and creating financial statements. The financial statements made during these periods are very important for attracting potential investors or procuring loans from banks.

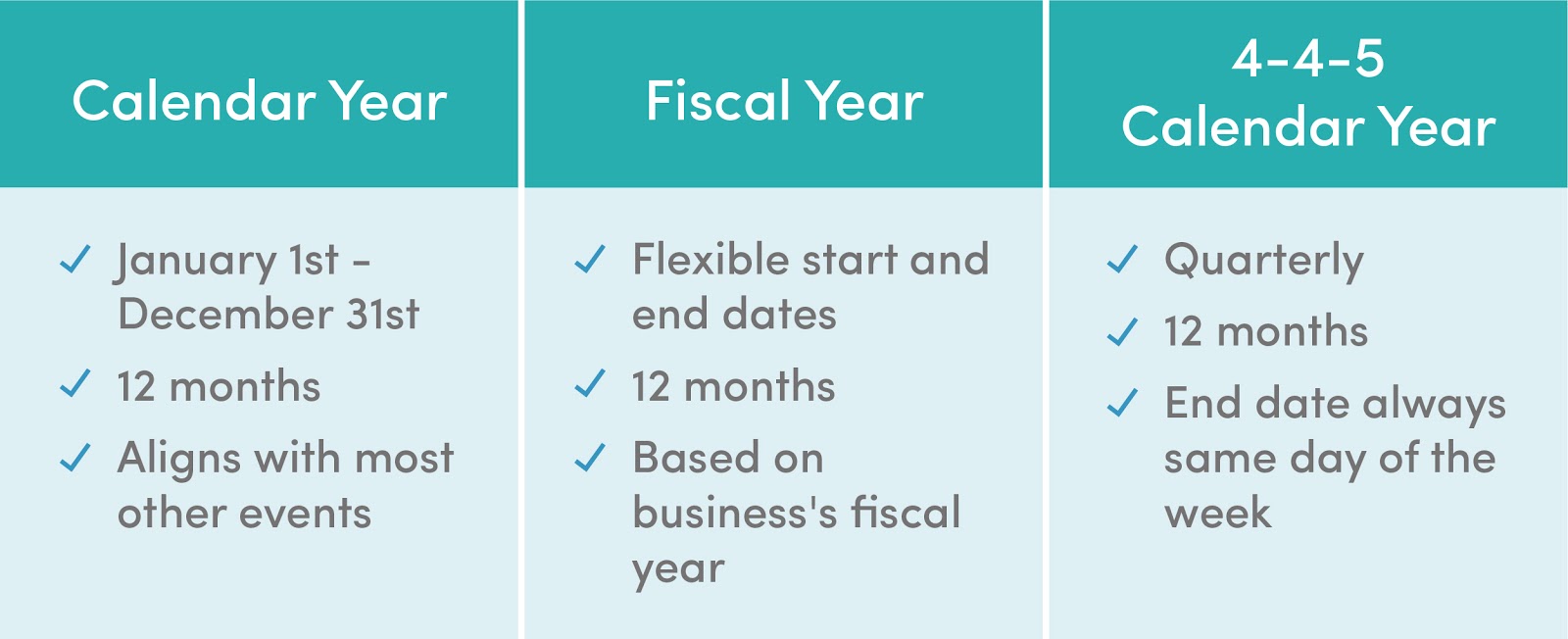

An accounting period can consist of any established time frame, although the most common are the week, the month, the quarter, and the fiscal or calendar year. Publicly-held companies are required to release quarterly reports to the Securities and Exchange Commission (SEC).

Accounting periods can (and do) overlap. For example, an accountant may aggregate data to create an income statement for the month of February. While the resulting income statement will only represent the February accounting period, the month of February will also be represented on the quarterly financial statements for Q1.

First and foremost, accounting periods need to be consistent. For example, if an accountant creates financial statements on a monthly basis, they must do so for each month of each calendar year. This is called periodicity, and having good periodicity will give decision-makers, investors, and banks a large, congruent sample size from which to make judgements on a company’s financial health and outlook.

When utilizing accounting periods, another golden rule is the matching principle. The matching principle is a key tenet of the accrual method of accounting. It requires that expenses are reported in the period during which they were incurred; likewise, all revenue must be reported in the period during which it was earned.

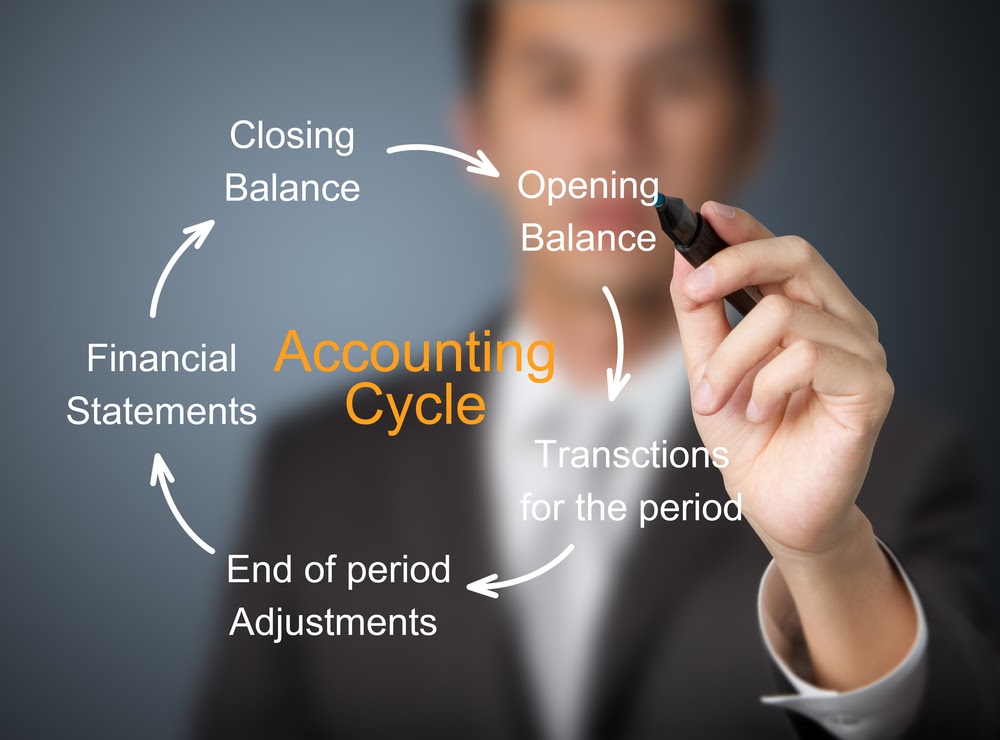

The accounting period is the time it takes to complete the accounting cycle. When the accounting period opens, accountants begin the cycle with reversing entries and end the cycle by closing entries and producing financial statements as the accounting period culminates. The cycle starts over as the next accounting period commences.

There are several standard accounting periods, including:

At the end of each accounting period, a business’s accountants will produce financial statements such as the balance sheet, the profit and loss statement, the cash flow statement, and the statement of change in equity. Well-crafted statements coupled with proper periodicity is critical for investors and banks to gauge the financial health of a business.

And, should your business ever trigger an IRS audit, periodicity will be your saving grace. The IRS can be very unforgiving when it comes to mistakes or inconsistencies on financial statements; they have no qualms about adding fines and fees to your balance.

A good accountant is an impeccable rule-follower — and there are a ton of rules in business finance. Many small business owners who attempt to do their own accounting find it to be tedious, complicated, and time-consuming.

For a small business, outsourcing accounting and bookkeeping to an outside firm is quick, easy, and rewarding. Every day, more and more small business owners make the switch to bookkeeping and accounting with FinancePal.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handleRead more “Bozeman Grooming”

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.