Sales Tax

Consulting Services

Filing incorrectly isn’t worth the risk. Let the tax experts at FinancePal handle your sales and use taxes for you, so you’re always in compliance.

Primary Accountant

Josh Turner

US Based

Experts Available

Dedicated Team

Financial help customized for small businesses.

FinancePal is your one-stop-shop for all your tax and accounting needs

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

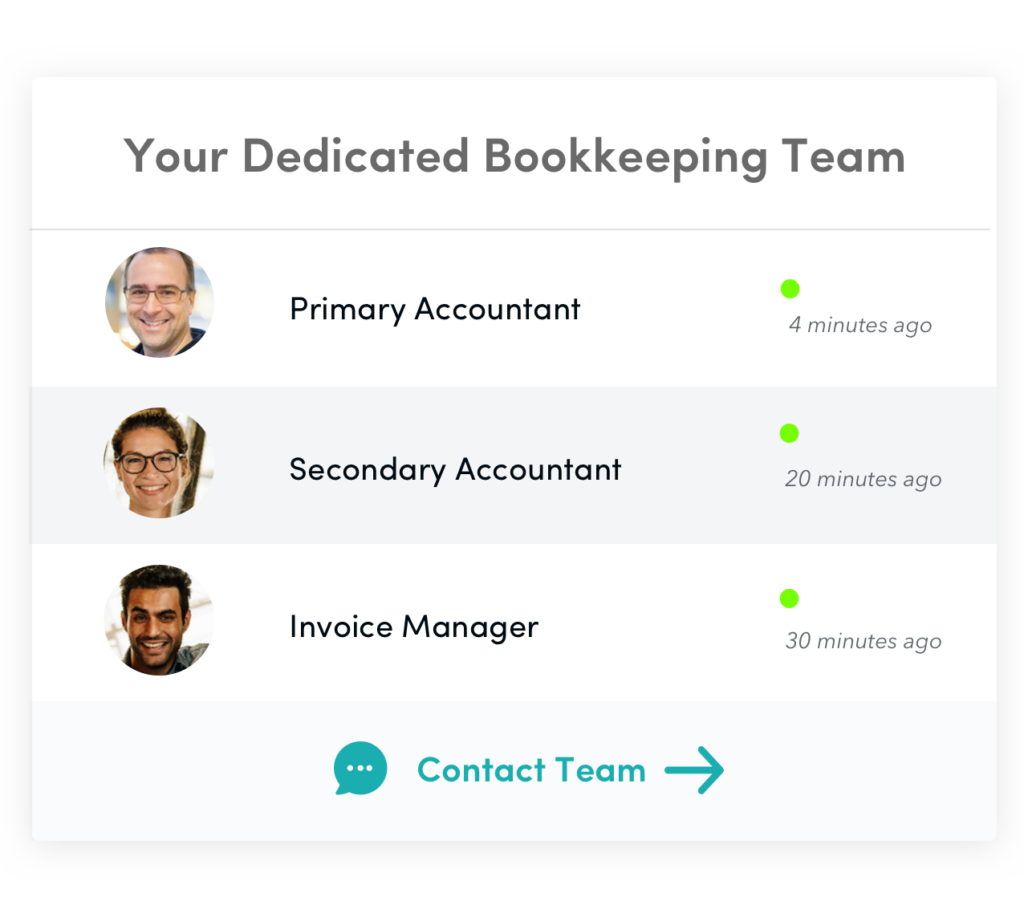

Your Personal Tax Experts

Let our financial team serve as your personal tax experts.

We’ll evaluate your liability for paying both sales and use taxes based on where your business operates

We’ll keep your business compliant and up-to-date with all government tax laws

We’ll stay on top of ever-evolving tax legislation so you remain in compliance

With our sales tax advisory services, you no longer need to worry about whether you’re going to be audited or fined due to tax mistakes—we have you covered.

Licensed Tax Professionals at Your Service

Our team is made up of seasoned tax professionals, including tax attorneys. We’re based right here in the United States and ready to provide timely, attentive service that you can trust. As part of the Community Tax family, our tax professionals can assist you with sales and use tax questions, as well as any other concerns you may have.

Services We Offer

We aren’t your ordinary sales and use tax consulting firm—we’re your one-stop shop for all your small business financial needs. In addition to sales tax advisory services, we provide:

Accounting

Bookkeeping

Tax Preparation

Payroll

Catch-up Bookkeeping

With FinancePal, you can enjoy the peace of mind that your taxes and finances are squared away.

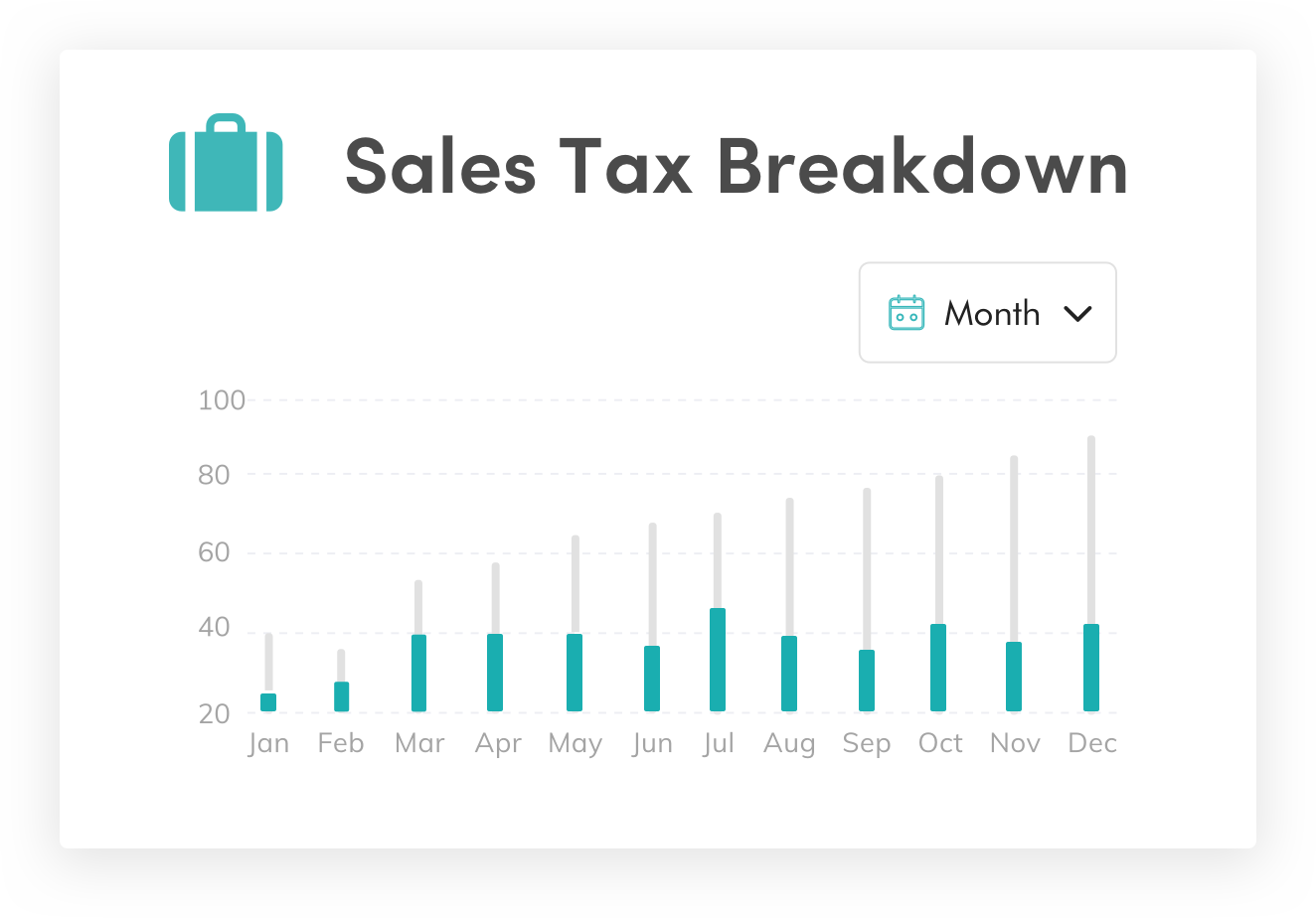

How Does Sales Tax Consulting Work?

We offer expedient small business sales tax consulting services for your company, designed to provide you with a better understanding of your obligatory state and local taxes. And when tax season comes, we can also help you file to ensure that you’re in compliance with tax authorities.

Our team is knowledgeable about sales and use tax laws across the country and has the professional insight you need to ensure that you remain in good standing. By analyzing your business’s sales transactions, the states in which you operate, and your situation’s unique requirements, we can help you file correctly.

Why Do You Need Sales & Use Tax Consulting?

Ensuring your business is following tax laws is important to avoid fines and violations that could hinder your company financially. With the help of FinancePal’s sales tax advisors, that’s something you won’t have to worry about.

Sales Tax Consulting for Service-Based Businesses

Our sales tax consulting service will prove especially helpful if you run a company that provides services rather than a retailed product. Most states don’t charge a sales tax on services, but a few do; those states often use very intricate guidelines to determine whether or not your company is compliant. These guidelines may be difficult to interpret, but our team can demystify confusing regulations to keep your company in compliance.

Sales Tax Consulting for Product-Based Businesses

E-commerce Taxes

E-commerce is a relatively new industry, and the laws surrounding it are complex and ever-changing. One of the most difficult aspects of online sales is the dreaded use tax. You may have to pay use taxes if you’re selling a product or service to a buyer in another state. Use tax laws vary by state, and sometimes they might be assumed by either your company or the buyer-depending on the jurisdiction and transaction type. If you conduct a heavy volume of online transactions, you could quickly find yourself in a mess of ambiguous tax obligations.

Retail Taxes

If your business relies on retail transactions, then sales tax is of particular concern. You need to file your sales taxes accurately; otherwise, your company may be subject to a tax audit. At FinancePal, we know that organized records of business transactions are the key to correctly filing sales taxes. This is easier said than done; businesses of all sizes can easily become overwhelmed by the massive amount of required transnational data. But with our team backing you, it’s out of sight and out of mind.

Our tax experts know the ins and outs of use tax requirements and can accurately calculate how much use tax you owe, if any.

Don’t just take our word for it.

FinancePal has been providing accounting services to both my company and my personal accounts for four years or so. If you ever need any accounting service, I strongly recommend working with them.

Frequently Asked Questions

In most states, businesses are required to collect sales and use taxes from consumers. Your state’s Department of Tax and Fee Administration can provide more information on the sales tax laws you’re required to abide by. Or, one of our sales tax advisors can help you determine whether you’re responsible for paying them, and how much you owe.

There are currently five states that don’t require sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. If you operate and sell in these states, you don’t have to worry about it for now. But if you’re selling or operating in other states, it’s more complicated as it varies significantly. One of our knowledgeable consultants can help you determine whether your state imposes sales taxes.

In some cases, you will only be required to collect sales tax for online sales if you have a physical presence in a state that you’re selling in. However, legislation is rapidly changing, with more and more states requiring tax collection on online purchases. As such, it can be difficult to accurately determine if you’re not familiar with state tax laws.

Don't just take our word for it.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handleRead more “Bozeman Grooming”

Financial help customized for small businesses.

Financepal is your one-stop-shop for all your tax and accounting needs

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.